estate tax exemption sunset date

If proposed tax changes become law it could change some peoples long-term estate-planning strategies. You may recall that the 2017 Republican tax reform legislation roughly doubled the estate and gift tax exemption.

Do You Know The Times In Life When You Should Really Update Your Will Read These 12 Life Changers That Should Estate Planning Estate Tax College Savings Plans

Because the exclusion amount is back to 115 million your estate tax is 46 million.

. Its 1158 million for deaths occurring in 2020 up from 114 million in 2019. 1 2026 the estate tax exemption is set to drop back to what it was before 2018. Who pays gift and estate tax now.

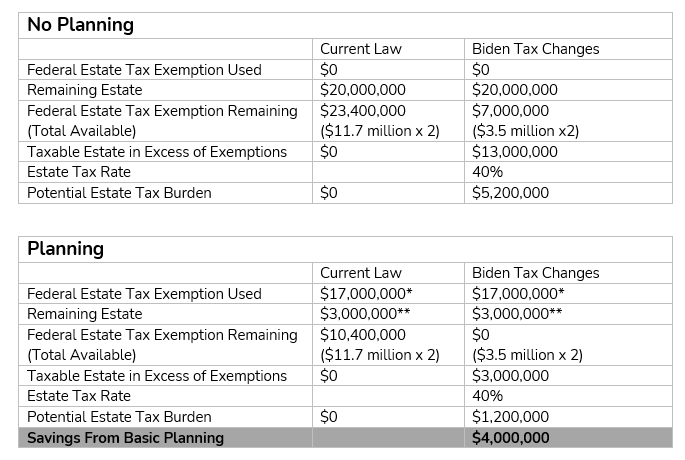

The current 11700000 federal estate tax exemption amount would drop to 5 million adjusted for inflation as of January 1 2022. The estate tax due would be zero. Nothing has happened politically and the doubling of the estate and gift tax exemption is scheduled to sunset on January 1 2026 at the end of the 7 th year.

However the favorable estate tax changes in the TCJA are currently scheduled to sunset after 2025 unless Congress takes further action. For couples the exemption is 228 million. The credit to be applied for purposes of computing Bs estate tax is based on Bs 182 million applicable exclusion amount consisting of the 68 million basic exclusion amount on Bs date of death plus the 114 million DSUE amount subject to the limitation of.

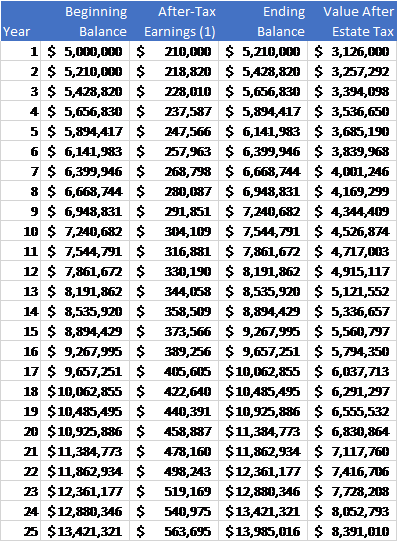

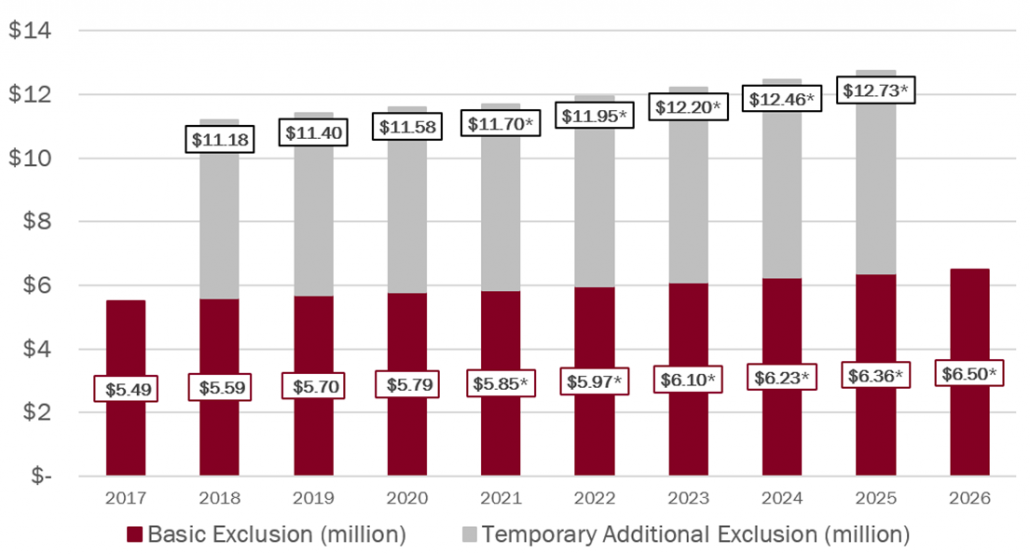

The federal estate tax exemption is indexed for inflation so it increases periodically usually yearly. 1 Any funds after that will be taxed as they pass. This temporary exemption is set to sunset in 2025 and would revert to the previous limit likely around 58 million when adjusted for inflation.

Under current law this exemption is planned to sunset to 5 million adjusted for inflation on January 1 2026. In this case on Jan. 5 million adjusted for inflation.

Importantly the current doubled base exemption value of 10000000 is slated to sunset meaning that it will revert to 5000000 effective January 1 2026 unless Congress acts to extend current law. Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025. With inflation this may land somewhere around 6 million.

In 2025 you both give zero to your heirs and you both die in 2026 with an estate of 23 million. Starting January 1 2026 the exemption will return to 549 million adjusted for inflation. If a decedent dies in 2026 with an estate of 11700000 the exemptio.

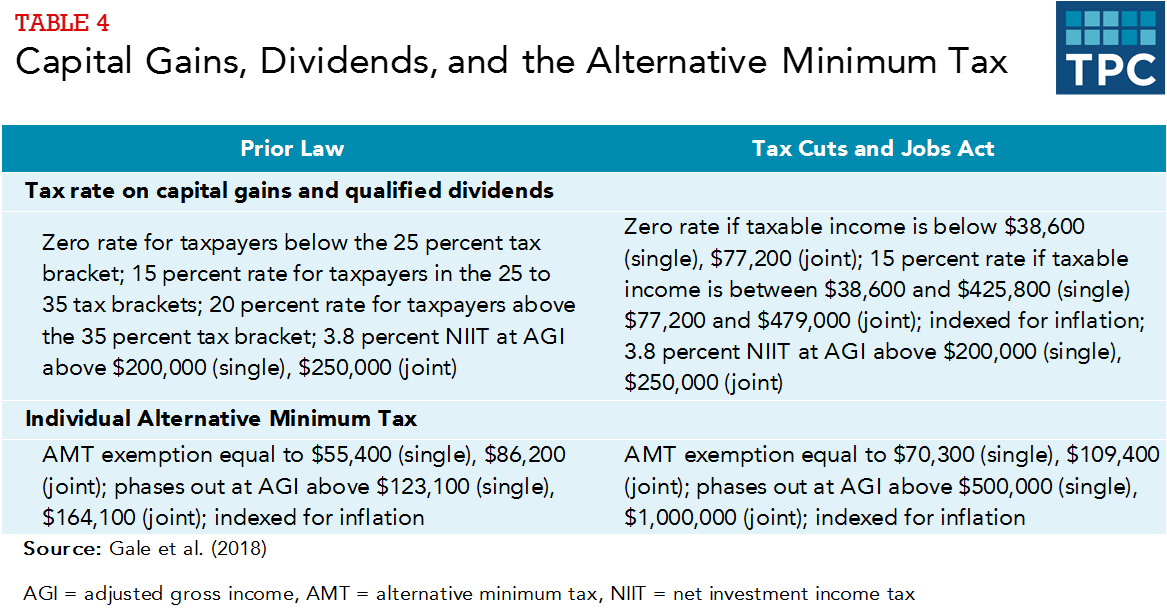

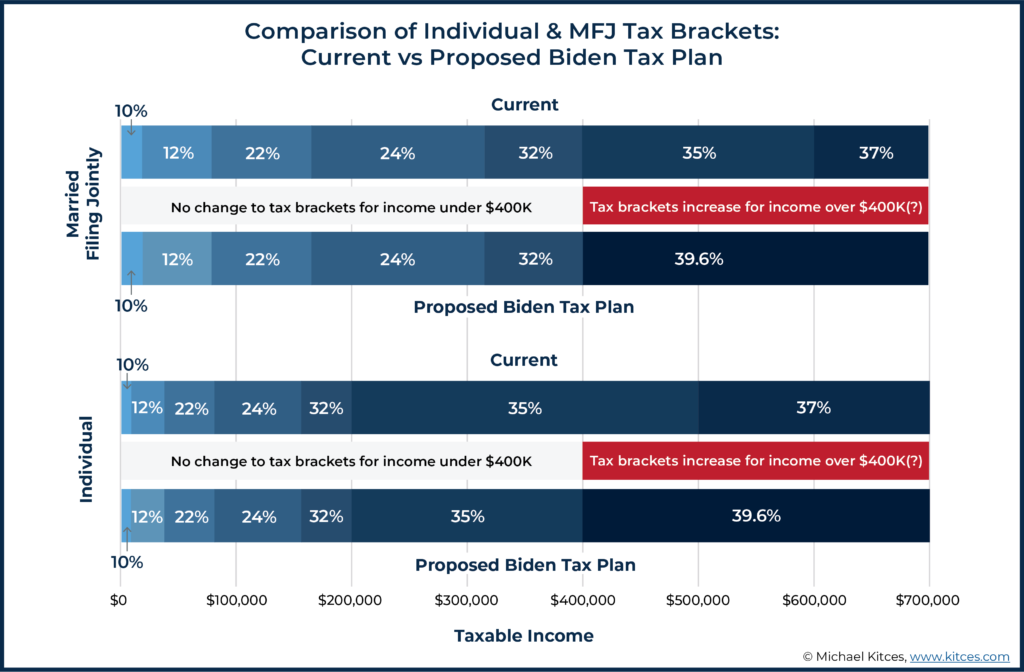

Under a special rule an estate can compute its tax using the larger exemption amount for gifts made during your lifetime or the exemption amount corresponding with the date of death. The Tax Cuts and Jobs Act which was enacted in December 2017 provided that the current 10000000 base exemption amount for the estate gift and Generation-Skipping Transfer taxes is effective through 2025 and reverts on January 1 2026 to the 5000000 base exemption amount established by the American Taxpayer Relief Act of 2012. President Biden did not include a plan to lower the estate tax exemption before the scheduled sunset date at the end of 2025.

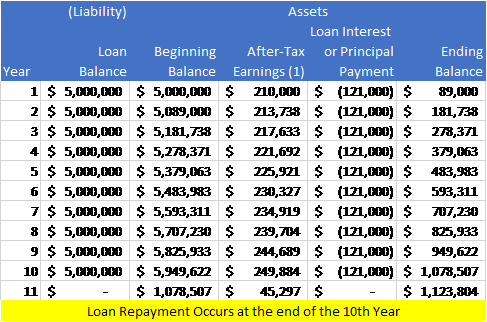

If your estate is in the ballpark of. The grantor of the trust has the flexibility to forgive the loan prior to the sunset date and complete the gift. Here is what you need to know about the proposal.

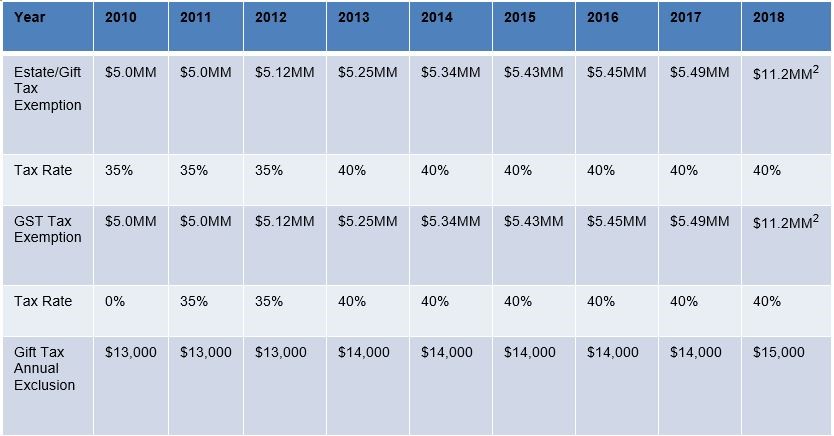

The current exemption amount is 10000000 per person adjusted for inflation in 2019 to 11400000. A plan introduced by Senator Bernie Sanders VT. For tax year 2017 the estate tax exemption was 549 million for an individual or twice that for a couple.

Couples can pass on twice that amount or 228 million. So if you make large gifts before 2026 you won t. And to find the amount due the fair market values of all the decedents assets as of death are added up.

California does not currently have a state estate tax though recent unsuccessful legislation proposed one while some other states do. Visit the Estate and Gift Taxes page for more comprehensive estate and gift tax information. The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation is expected to be.

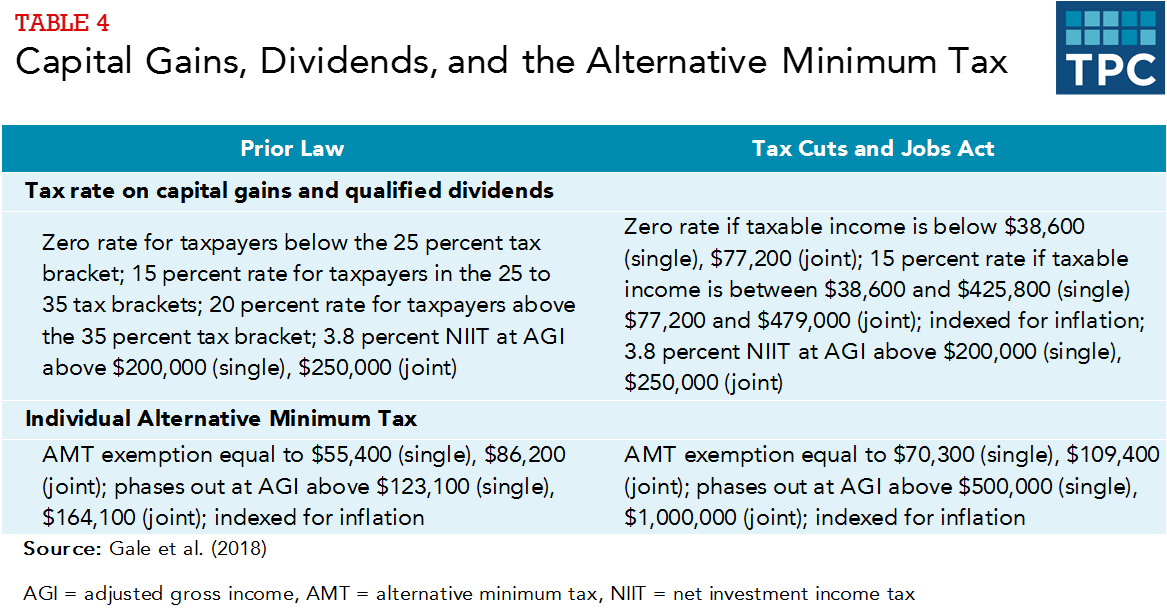

The proposals clarify that individuals who leverage the increased exemption wont be affected after 2025. Notably the TCJA provision that doubled the gift and estate tax exemption from 5 million to 10 million adjusted annually for inflation will revert to pre-2018 levels after 2025. The gift and estate tax is a federal tax.

The 2021 tax year limit or the amount limit in 2022 after adjusting for inflation is 1206 million up from 117 million in 2021. Its basically 11 million plus inflation adjustments. Making large gifts now wont harm estates after 2025 On November 26 2019 the IRS clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 will not be adversely impacted after 2025 when the exclusion amount is scheduled to.

This means starting in 2019 people are permitted to pass on tax-free 114 million from their estate and gifts they give before their death. However the new tax plan increased that exemption to 1118 million for tax year 2018 rising to 114 million for 2019 1158 million for 2020 117 million for 2021 and 1206 million in 2022. The Federal Estate Tax Exemption.

January 1 2022 EstateGift Tax Exemption Cut in Half Currently the gift estate and GST tax exemptions are each 117 million per person for 2021. This resulted in a unified lifetime exemption of 11400000 in 2019 and 11580000 in 2020. We arent sure what you will be living on between 2025 and the date of your death but at least no death tax will be payable.

The federal estate gift and generation-skipping transfer tax exemption amounts are currently set at 1158 million per individual or 2316 million for. The estate tax is a tax on an individuals right to transfer property upon your death. Even if significant changes dont happen current lifetime exemptions for gifting are set to expire at the end of 2025 which could cause concern for the way some estate plans are constructed.

No Cell Phones Sign Printable Elegant Schedule Template Project Diary Excel Journ Business Plan Template Free Rental Agreement Templates Business Plan Template

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

New York S Death Tax The Case For Killing It Empire Center For Public Policy

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

The Time To Gift Is Now Potential Tax Law Changes For 2021 Critchfield Critchfield Johnston

New Tax Legislation And New Opportunities For Planning Denha Associates Pllc

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

The Generation Skipping Transfer Tax A Quick Guide

Estate Planning Opportunities In 2020 Homrich Berg

Biden Tax Plan And 2020 Year End Planning Opportunities

New York S Death Tax The Case For Killing It Empire Center For Public Policy

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Will The Lifetime Exemption Sunset On January 1 2026 Agency One